Every One. All Ways.

Ways to

Give

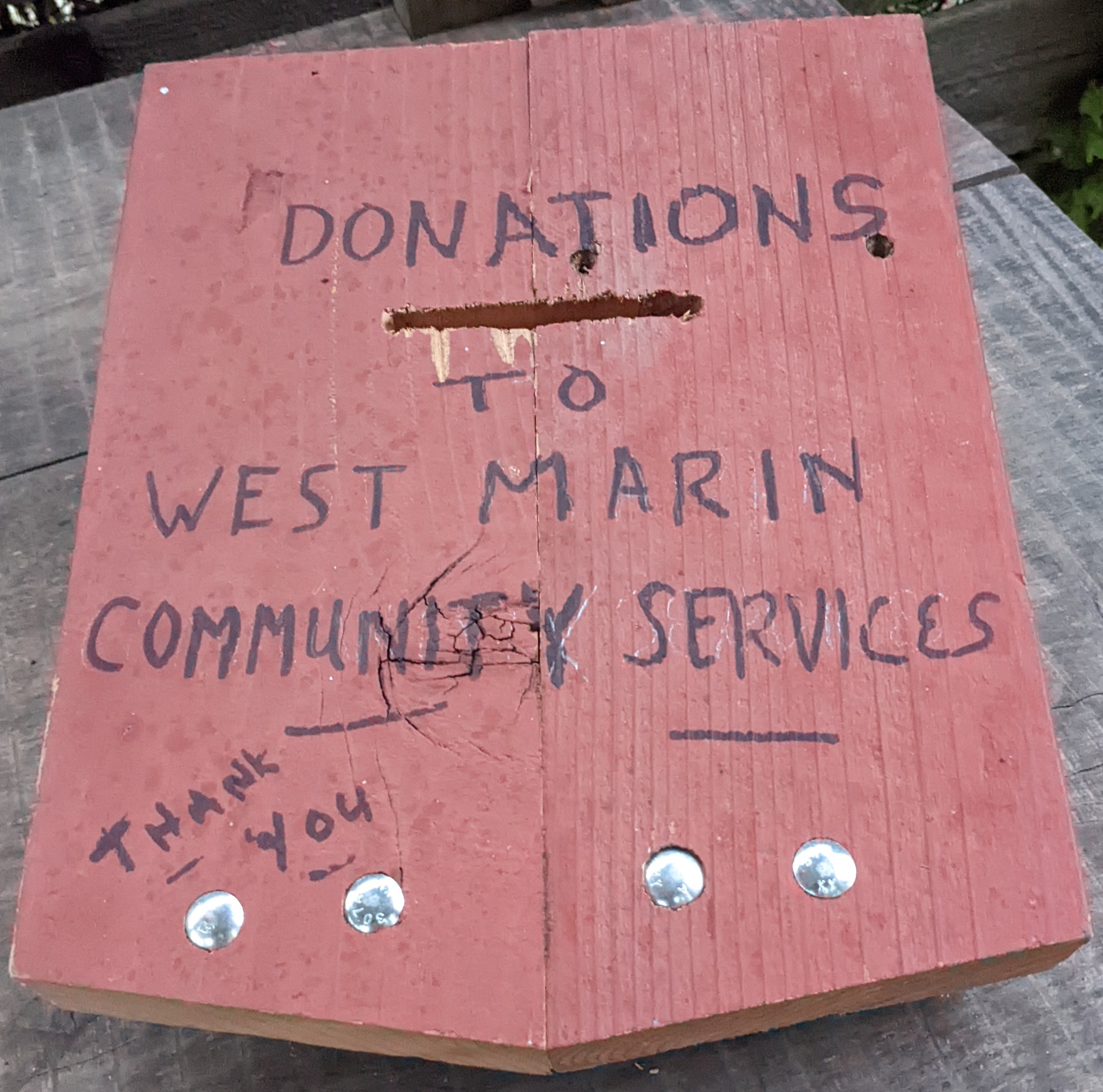

There are a variety of different ways that you can donate to WMCS to help keep our doors open and our programs up and running.

Give Money

We believe a strong community is one where we all look out for each other. If you agree, please consider a donation. Every dollar makes a huge difference in the lives of local people. All donations are tax deductible and are immediately implemented into our programs.

Our federal tax ID# is 68-0197586

Online

West Marin Community Services

P.O. Box 1093

Point Reyes Station, CA 94956

Collaborative Community Fund

Celebrate WMCS 25th Anniversary and invest in the next 25 years by giving to our Collaborative Community Fund!

Give Food

Clean paper grocery bags for Food Pantry. Drop off while we’re open. We always need bags!

Hours: Monday, Wednesday, Friday 9am-1pm

Tuesday and Thursday 12-4pm

Closed Saturday and Sunday

Location: 11431 CA-1 Suite 10, Point Reyes Station, CA 94956

Give Goods

A car, boat, truck or other vehicle that you no longer use

Donate it to WMCS. We’ll make arrangements to tow it away, you will receive a tax receipt, and we will get the proceeds from the sale of the vehicle. To make sure your vehicle qualifies, contact CARS at 855-500-RIDE (7433), careasy.org.

Quality Goods for the Thrift Store

Drop off your items in clean, usable condition during Thrift Store hours

Youth Center

Food, art supplies, expertise and sports equipment are always appreciated.

Volunteer Your Time and Skills

The Food Pantry is a vital resource for our community. We receive large food deliveries where many hands make light work. Our ideal volunteers can lift boxes up to 30 pounds and help with food sorting during these deliveries.

Be a part of the support for our Food Pantry, residents with emergency needs, scholarships for childcare, and many other much-needed projects. Shifts are typically a couple of hours of organizing the retail floor and donations or cashiering. Weekly or monthly commitments are much desired!

Love sports? Tutoring? Cooking? Art? Biking? Computers? The youth are eager to learn and interact with the community. Whether you come every week, or just drop in to play sports every once in awhile, your presence is important!

Need young people to help on a community project? Have an activity or an experience you think West Marin youth would love to participate in? Please let us know, call today!

Waterdogs

The Waterdogs Swim Program has been teaching kids to swim in Tomales Bay for over 60 years. Kids who complete this program are rewarded with an American Red Cross swim safety certification. We need volunteers to help make this two-week class safe and rewarding. Working with a trained instructor, volunteers are in the water with small groups.

Abriendo Caminos (Finding Our Path)

Through this Latino engagement program we function as a bridge between the immigrant population and the larger community. We are looking for bilingual and bicultural Promotores to serve as key community members to connect the Latino community to vital resources. Occasionally, we will also need event volunteers to assist with food, set up, and clean up during trainings.

Holiday Food and Gift Program

Every holiday season at the end of the year we provide food and gifts to low-income families in partnership with Point Reyes Books, the California Highway Patrol, and the Dance Palace Community Center. Volunteers help with sorting toys, packing food boxes, and distributing gifts.

Donate a Portion of Your Investments

Stocks, Bonds and Mutuals

Save on income taxes when you donate stocks, bonds, or mutual funds.

You may direct your brokerage to transfer the shares to:

West Marin Community Services

Vanguard Brokerage Account 48013031, DTC Code 0062

Vanguard Mutual Fund Account 88064177645

Please let us know the shares are coming so we can send you a tax receipt and thank-you letter after they arrive. If you don’t let us know about the transfer, we won’t know it came from you, as Vanguard is prohibited from telling us.

Individual Retirement Accounts

Are you age 70½ or older? Do you have an annual requirement to withdraw a certain amount from your IRA?

If you answer ‘yes’ to both questions you can submit a Qualified Charitable Distribution (QCD). This arrangement can save on taxes and, potentially, on Medicare B premiums.

Please discuss these strategies with a trusted tax or investment adviser to make sure you will benefit, as everyone’s situation is different.

Legacy Giving

There are many different options, offering a variety of tax advantages, for including WMCS in your estate planning and leaving a legacy for the community.

For example, your will or living trust or make West Marin Community Services the beneficiary of your Traditional IRA. Directing your IRA custodian to make WMCS a beneficiary can be a tax-wise strategy that is free (or inexpensive) and easy to implement.

Other strategies, offering various advantages, are more complicated and may require the services of an attorney. Please call or email us if you would like to discuss a gift of this kind or consult with your professional estate planner.